Understanding the tax consequences of selling inherited property is crucial for financial planning. This guide will help you navigate the tax implications when you sell a house you inherited in Texas.

Tax Consequences when Selling a House I Inherited in Texas

When you inherit a home, it can bring up many different feelings. You now have a perhaps valuable property that could improve your life, but you also just lost someone near and dear to you.

When deciding what to do next, it’s important (and wise) to know how taxes affect selling an inherited property. The good news is that tax laws are generally designed not to place additional burdens upon the person who inherits the property.

The tax consequences aren’t usually as scary as you think, which is good news for those inheriting property. If you want to talk about it to someone who cares, contact us at US Direct Home Buyers and see if we’re as straightforward as we say.

Disclaimer: This article is just general information. We are not attorneys. You should always consult an attorney or financial advisor knowledgeable about this area of the law and your situation.

How Do I Figure My Taxes on My Inherited House in Texas?

Calculation of Basis

To understand taxes when you inherit a house, you need to know about “basis.” The basis is the property’s starting value for tax calculations like capital gains. In Texas, when someone dies, the property’s value is updated to its worth on that day.

For instance, if a person bought a home for $25,000 and its value was $100,000 when the owner died, the $100,000 value is used to calculate taxes.

Understanding Capital Gains and Losses in Real Estate

Capital gains or losses are the financial outcomes derived from selling assets such as properties used for personal use or investment purposes. These assets can range from residential homes to furniture and more.

When you decide to sell an inherited property in Texas, the transaction is categorized as either a capital gain or loss, impacting your income tax obligations. For a non-inherited property, the reduced long-term capital gains tax kicks in after you possess the property for one year.

Good news: Regardless of how long you own the inherited property, any resulting profit or loss is considered long-term for tax purposes, giving you a lower tax rate! Call or text us at (832) 662-2202.

We can’t advise you on tax matters, but we’re good with numbers and can assist you in interpreting the numbers when deciding what to do. Simply put, US Direct Home Buyers cares. Call or text us at (832) 662-2202.

Reporting the sale

When you sell an inherited home, you must report it to the IRS. First, determine whether you gained or lost money. Then, remove the basis (see above) from the selling price. Then, you report that amount to the necessary authorities.

Inheriting a home can be challenging because you suddenly have a new property to manage and taxes to handle. The first thing to do if you want to sell your inherited home in Texas is to go through the probate process.

The court will let you sell the house at the end of this process. If you share the inheritance with others, the heirs must agree before selling. After that, you can ask the court for permission to sell by filling out a form.

Next, consider the taxes you’ll need to pay. The amount depends on whether you made or lost money from selling the house. Call us at US Direct Home Buyers at (832) 662-2202 for an easy and legitimate sale. We know the Texas market and can help.

Selling an inherited home can relieve you of a burden. Selling to an investor is also quick and straightforward. Contact us if you need help selling your home in Texas. We’ll gladly help.

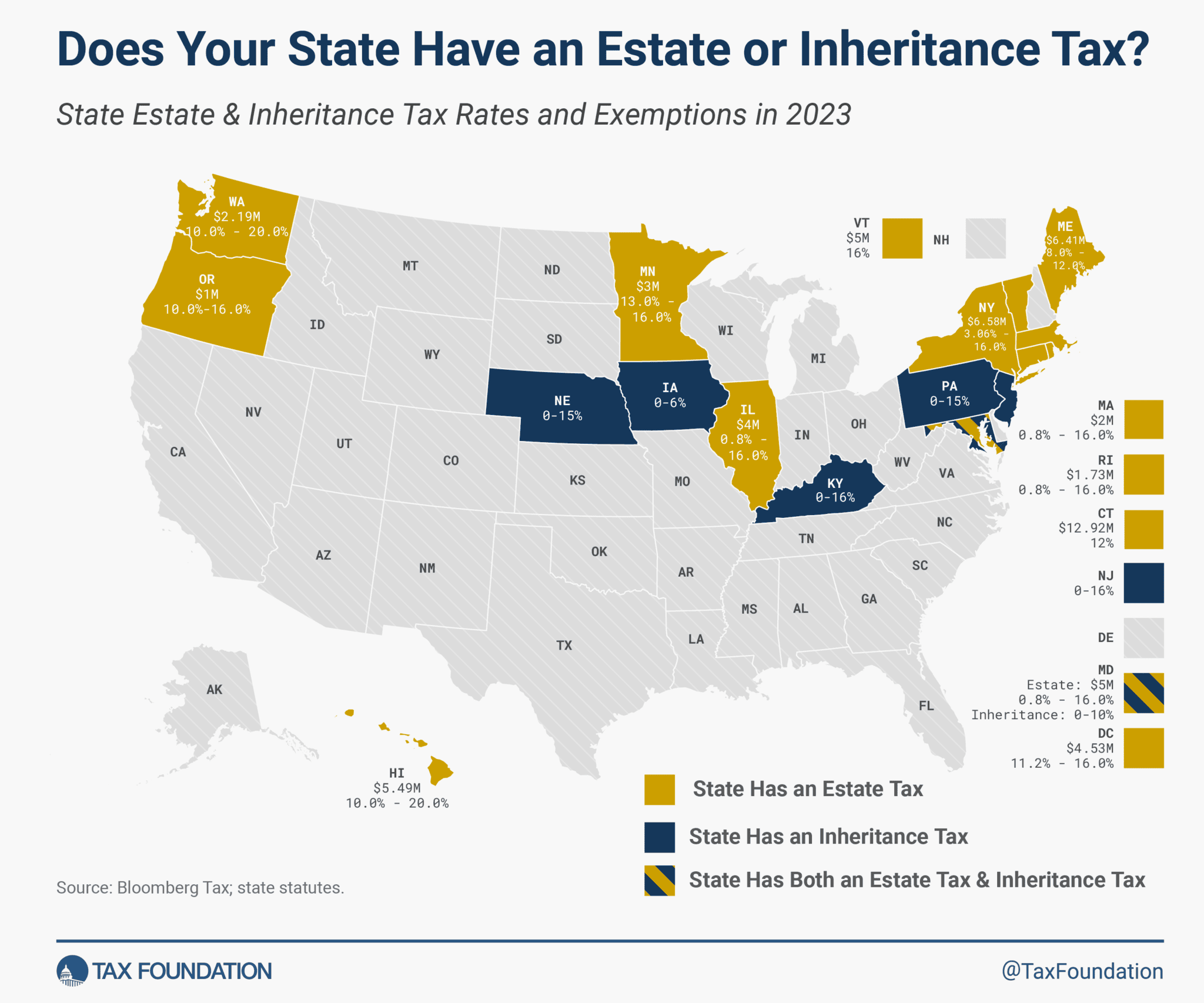

Does Texas Have an Estate or Inheritance Tax?

As a real estate investor, it’s essential to understand the tax consequences of selling a property in states with inheritance or estate taxes. Maryland imposes both taxes, which can impact the net proceeds from a property sale.

Estate taxes are levied on the deceased’s estate, while the beneficiaries pay inheritance taxes. These taxes can significantly affect the amount of money heirs receive. Consulting with a tax professional can help you navigate these complexities and optimize your financial outcomes. For more details, visit Tax Foundation.

Disclaimer: This article is just general information. We are not attorneys. You should always consult an attorney or financial advisor knowledgeable about this area of the law and your situation.

Related Articles on Inherited Property in Texas

Niche-Inherited_ClusterTX02

![Tax consequences when selling a house I inherited in [market_city]](https://cdn.carrot.com/uploads/sites/21170/2024/08/Tax-consequences-when-selling-a-house-I-inherited.webp)